89dac51957784182a84894403e6f37f9.png?sfvrsn=1475e960_1)

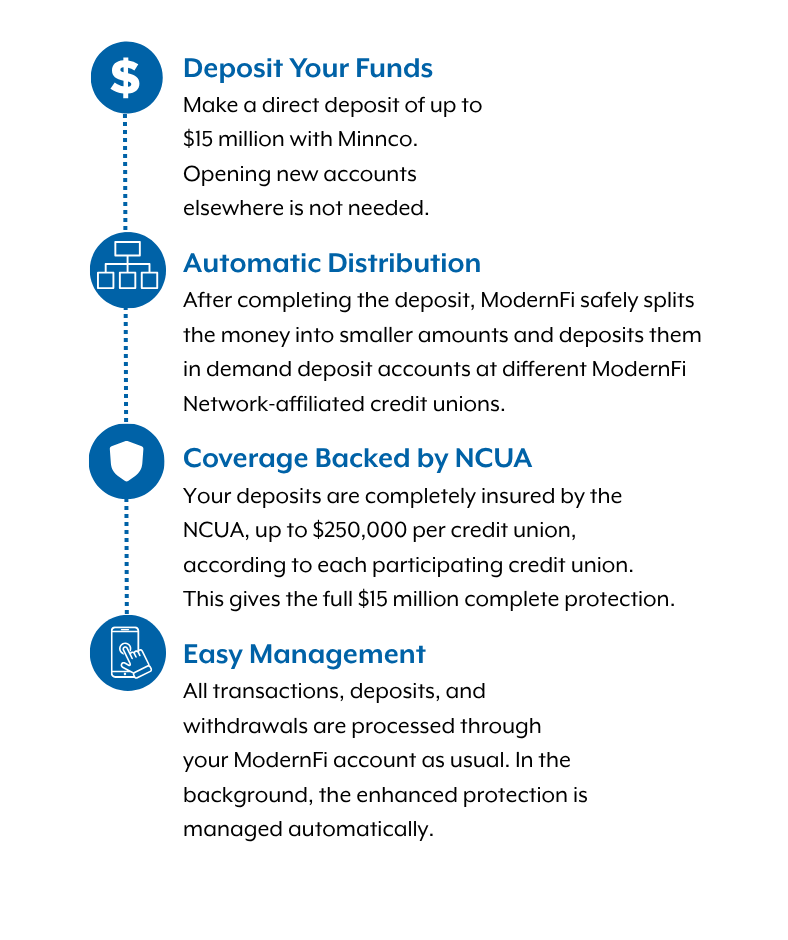

An Extended Insurance Account provides millions of extended NCUA insurance on your deposits by distributing your balances in amounts under the $250,000 threshold to partner credit unions in our deposit network. By placing funds under the limit, your entire balance can be insured by the NCUA. These accounts combine to provide you with extended insurance coverage.

You control the account just like a regular transaction account. You can deposit, withdraw, or transfer funds at any time through a dedicated Member Portal. Minnco Credit Union and Modern Fi manage and oversee your allocation, ensuring funds are distributed to demand deposit accounts within the network.

ModernFi, our deposit network provider, partners with credit unions in good standing with regulators and compliant with all Anti-Money Laundering and Know Your Customer requirements. ModernFi only places deposits at US-based NCUA-insured credit unions that are monitored by a U.S. federal or state government agency responsible for the supervision of financial institutions.

Furthermore, you and Minnco Credit Union always have full transparency into the allocation of your funds.

Yes, you have full transparency into the allocation of your funds.

Extended Insurance Accounts offer a high degree of security for your deposits, utilizing NCUA insurance to safeguard funds up to $250,000 per member at each participating credit union. This protection extends even in the event of a participating credit union's failure, ensuring the continued safety of your deposits. Since the inception of the National Credit Union Share Insurance Fund in 1970, no member has lost NCUA-insured funds due to a credit union's failure. All accounts at NCUA-insured credit unions are covered on a dollar-for-dollar basis, encompassing principal plus any interest accrued.

In the unlikely event a credit union fails, the NCUA assumes the responsibility of closing the credit union, receives its assets, and settles all deposit claims. Minnco Credit Union works with ModernFi, our deposit network provider, to file all required materials with the NCUA to coordinate the receipt of your funds from the failed institution.

The account is flexible. Members can deposit, transfer, and withdraw money at any time, just like a regular demand deposit account.

Funds participating in the Minnco Credit Union Extended Insurance Account are deposited into accounts at participating credit unions, which are insured by the National Credit Union Association (NCUA) for up to $250,000 for each category of legal ownership, including any other balances you may hold directly or through other intermediaries, including broker-dealers. The total amount of NCUA insurance for your account depends on the number of credit unions in the program. If the balance in your account is greater than the NCUA insurance coverage in the program, any excess funds will not be insured. Please read the Program Terms and Conditions carefully before depositing money into the program, and for other important customer disclosures and information. To assure your NCUA coverage, please regularly review credit unions in which your funds have been deposited, and notify Minnco immediately if you do not want to allocate funds to a particular credit union or credit unions.

Minnco has supported my ability to provide the best care for my horses. They financed a trailer so I could haul them to receive medical care, and they provided financing so we could build stalls. As any horse owner will tell you, horses are the best part of my day, and they keep me sane. Minnco gave me the ability to be a better horse mom.Denise S -90th Anniversary Testimonial

Minnco has always been easy to work with for all of my questions and loan needs.Paul S.

Love the friendly, knowledgeable staff that will go above and beyond if/when needed. Great service without the corporate feel of the big banks.Sandy S.

I love it when I come through the drive through and they know who I am and call me by name. This is personal service which is missed in the world today. It makes me feel like I am valued by Minnco.Emilie B.

Minnco was there when we needed money for home improvements. They were also there when we needed a costly water treatment system. The company we purchased the water system from originally financed us through a high-interest rate loan, which we quickly transferred to Minnco at a much lower interest rate. Way to go, Minnco!Tricia K -90th Anniversary Testimonial

It's not a national level chain of branch offices... it's local banking for local people.Paul A.

Local, hometown, friendly bank. Due to the downturn in the economy many years ago, Minnco made it possible for us to get our life back on track financially after a job loss. We wouldn't be where we are today without their help years ago.Anne R.

I love Minnco because they have always been there to help me with my banking needs. The staff are always super friendly whenever I have any questions.Cheryl W.

For the past 15 years, Minnco has empowered my husband and me to live our best lives! We are big outdoor enthusiasts, and Minnco financed several toys for our outdoor enjoyment (fishing boat, Ice Castle, and multiple ATVs). Thank you for investing in us!Isaiah and Jessicah R -90th Anniversary Testimonial

Joanne K -90th Anniversary TestimonialIn 1996, my husband and I were looking to become first-time homeowners. We knew we were going to need a loan, so we decided to look in the community where we hoped to live and raise our family. We approached a few banks and then learned of Minnco. The reception, respect, and support we received at our first appointment secured the deal and we have been members ever since.

For the first time ever, my card was compromised. Soon as I noticed it, I contacted Minnco. They were fast and efficient on taking care of my issue. They immediately put my concerns at ease. My account is back in order and a heavy weight was lifted off my shoulders. I am so grateful to know that my finances are in safe hands!Tara C

Sharon K -90th Anniversary TestimonialI have been a member of Cambridge Co-op Credit Union/Minnco Credit Union for about 60 years. When I was 18, I bought my first car after getting a loan from Andre. For myself and my five brothers, all we had to do was give him our name and he trusted us and we got the loan, no questions asked. This created trust and respect that has lasted my entire life.

I love Minnco because everyone is friendly and efficient. You can build a relationship with the staff at Minnco and be welcomed with a friendly face.Laura D.

Fantastic service & very competitive rates. They are always willing to go above and beyond for members.Samantha S.

I love Minnco because they always make everything so easy. I have had several loans and the process is quick and easy.Cynthia

Scott and ErinWe purchased the Route 66 warranty for our Chevy pick up. It was a great decision because the transmission went out on us 6 months later. The warranty saved us $3,300. The only thing we had to pay was the sales tax of the transmission. They were so wonderful to work with and it was so easy. We strongly recommend investing in the Route 66 warranty!

I love the people, I love the ease ability of banking, and there is never any hassle when it comes to working with Minnco.Jeff W.

Always there right away when I need them!Suzannah M.

Minnco is a great place to do business and belong to as a member!Kat E.

I love Minnco because of the fast service and friendly faces.Miah G.

Select a Location